Simply put, the answer to the above query is to invest in asset classes that will generate a post-tax return that is more than or equal to the rate of inflation. As a result, inflation decreases the purchasing power of the people, or the ability to afford goods and services, as a result of the increase in prices. Investing and saving during inflation is not easy, and it gets harder the more inflation occurs. However, there are steps you can take to make investing and saving during inflation a little easier. This article will look at how to ace investing and saving during inflation.

In what ways does inflation affect your savings and investments?

Increased prices have an impact on your cost of living and consequently reduce the value of your savings and assets. It's because when inflation rises, your monthly savings or investments may not increase at the same pace. As a result, the price increase puts a further strain on your savings and assets. Due to the influence of inflation, the amount of money you have saved will be worth less and less in terms of products over time.

Even if you don't understand what inflation is, you may still feel its effects. We've all had the experience of going to the grocery store and spending far more than we had planned. Also, you can see that even though soap's price hasn't changed, its size has shrunk over time. This is referred to as inflation in the financial world.

What should you do to fight inflation in today's world?

To overcome inflation, you must invest in financial products like tax saving schemes in India and myriad investment plans that give you a higher rate of return as compared to the rate of inflation. Some of the investment options are investing in stocks, mutual funds, bonds, property, gold, systematic investment plans (SIPs), etc., to name a few. Such investments will grow your savings and provide you with a hedge against inflation. Consider your risk tolerance and long-term financial goals when you choose the best investments to fight inflation.

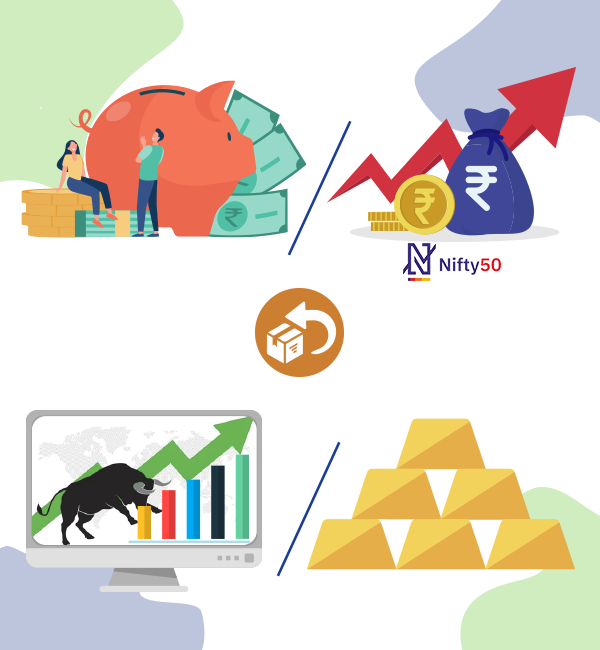

1. Invest in growth stocks, dividend-paying stocks, and consumer staples.

Stockholders have a higher chance of outpacing inflation than other types of financial investors. The increase in inflation is often passed on to consumers in the form of increased prices, and the same market factors that drive up inflation are also responsible for the rise in the valuation of businesses overall.

Inflationary pressures may be beneficial to consumer-driven stocks that are steady and provide dividends. A good investment is in food and energy because they are always in demand and businesses that sell them can raise prices while taking advantage of the rise in prices.

However, high-growth companies with high expectations but low profits would have a hard time in an inflationary environment.

2. Invest in mutual funds:

It is difficult for many investors to keep up with the movement of particular equities or the overall market every day. It is possible for them to invest in mutual funds after they figure out which fund is best for their needs and wants.

Many types of equity funds exist, including market capitalization-based, sectoral-based, strategy-based investing techniques, tax-advantaged, and more to choose from. Five-year and ten-year returns on most equity funds have regularly exceeded 10%.

3. Examine your spending and find ways to save.

When inflation is high, you should expect to pay more for just about everything, from groceries to petrol. Your finances will be better off if you're keeping an eye on your budget and sticking to a monthly spending plan. Stopping or delaying spending on things that are fun but not necessary could save you a lot of money in other parts of your life.

4. Look for opportunities to reduce your tax liability.

In order to battle inflation, you should seek tax efficiency in your brokerage account. The bottom line is that tax-efficient investing allows you to keep more of the money you invest since it reduces your taxable income. Inflationary pressures can be mitigated by finding tax-efficient ways to invest.

Get Free ebooks, guides & templates delivered to your email

We promise never to spam.

5. Invest in gold.

Gold has always been a popular investment for Indians since it doesn't require any knowledge of the market. When it comes to protecting against stock market volatility, gold is seen as a safe-haven asset. Because its costs and returns have risen in tandem with inflation, it's considered a solid inflation hedge. When inflation rises, demand for gold also rises.

Gold is not a financial asset, but rather a commodity. An analysis carried out by the World Gold Council found that every one percentage point (1% rise) in inflation results in a 2.6% increase in gold demand and that an increase in demand results in an increase in the gold price.

6. Real estate investment trusts (REITs)

If investing in real estate is out of reach owing to the high capital required, REITs could be an option. Real estate investment trusts (REITs) are businesses that own and/or operate assets such as apartment complexes, office buildings, retail malls, warehouses, and other commercial buildings. Essentially, they are an investment portfolio consisting of real estate that provides dividends to its shareholders.

When inflation grows, so does the value of real estate and the amount of rental revenue earned. With the flexibility to grow rental revenue and subsequently distribute it to shareholders, REITs do well during inflationary times.

Summary:

Keep in mind that every rupee you save today will allow you to purchase a lower amount of anything tomorrow. Maintaining your present standard of living will cost you more money in the future if you keep your existing lifestyle.

As a result, make prudent investment decisions now in order to battle inflation in the long run. Keep your money working and multiplying so that you may enjoy the same quality of life even a decade from now. If you invest well, you'll be able to fight inflation and meet your financial goals. This is why it's important to do so.